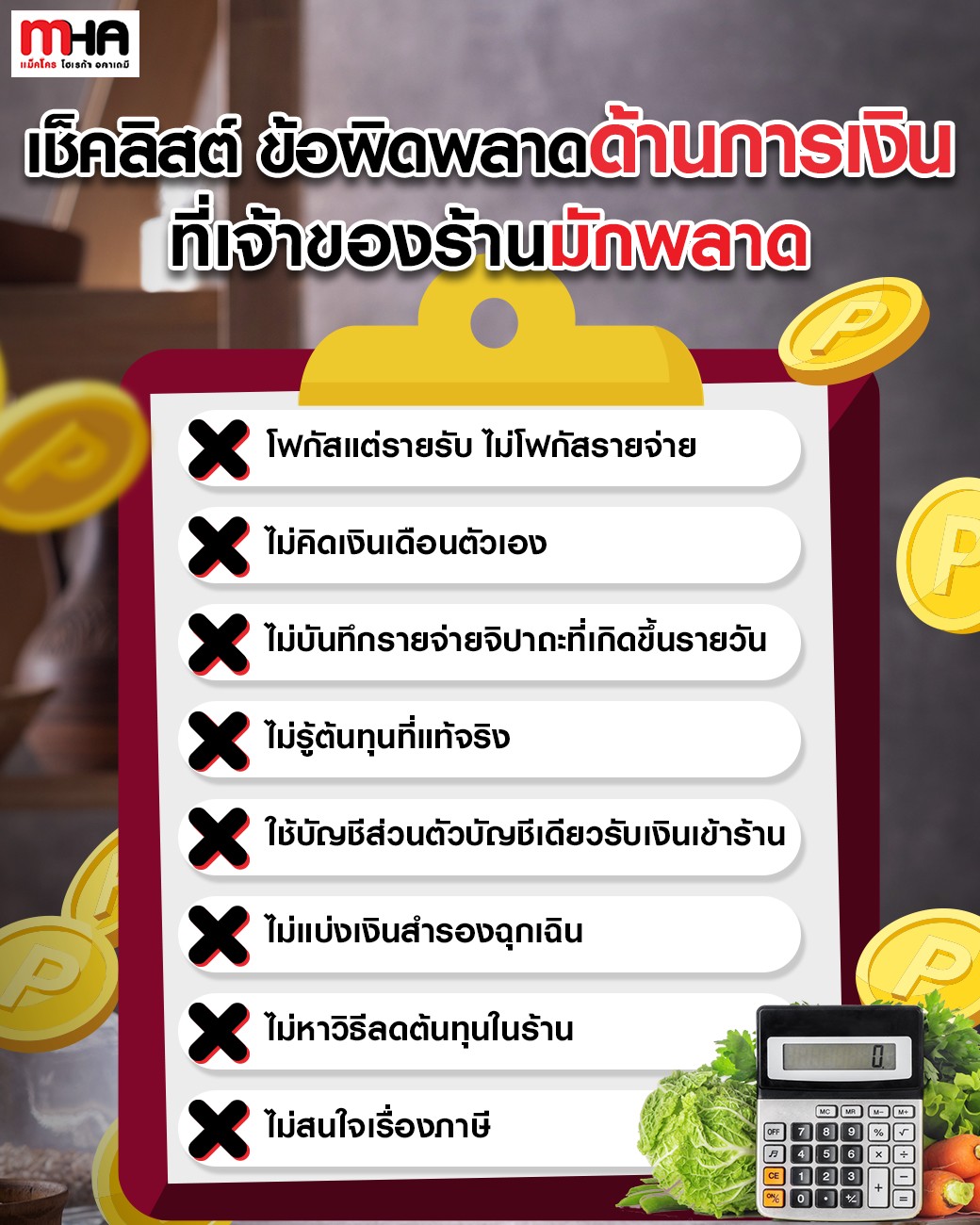

1) Focus only on income, not expenses. Many times, it is found that some of the money spent is not included in the calculation of income and expenses each month. The store's accounts are therefore not balanced, causing only profit to be seen, even though in reality, all expenses may have exceeded sales. Especially in cases where VAT registration is not included in the tax calculation, the expenses will be even higher than they really are. Therefore, whether income or expenses must always be given importance.

2) Don't calculate your own salary. Normally, many people think that being a shop owner doesn't need a salary because all the profits belong to the owner anyway. This has a very negative effect on the shop because it makes the cost structure lower than it should be and results in setting a low target profit as well. It can be called a missed opportunity to make a profit. Another reason is that if the salary is not separated from the profits, the working capital and personal expenses will be mixed together, which is very risky to "fail".

3) Neglecting daily miscellaneous expenses, not giving importance to spending, not recording, using the memorandum method, having to buy something and paying for it without recording. This is understandable if it is the first month, but if you do not record your miscellaneous expenses in detail, there will be no information to calculate the expenses for the following month, or it will result in the account balance and the actual remaining amount not matching.

4) Not knowing the real cost is the most common mistake that beginners make. Many people think that no matter how much they buy, it is only the cost. But in reality, the cost of each type of raw material cannot be calculated that easily. For example, 1 kilogram of sea bass costs 180 baht, or 18 baht per 100 grams. But when you buy it, you have to scale it, remove the bones, guts and heads, which leaves only 800 grams of usable meat. Therefore, the #real cost is 22.5 baht per 100 grams. In this section, you need to study how to calculate the yield value to find the real cost well before setting the price.

5) The store's cash inflow channel #Enter only one personal account. At this point, we will not be able to separate personal liquidity from business liquidity because the numbers are all mixed up. Separating the store accounts will help us see the money coming in and out of the store each month, see the costs and profits from the business clearly, and help analyze trends to know how to proceed with the store each month.

6) Not setting aside emergency funds. Unforeseen events can happen at any time. We saw an example from the recent COVID period when many shops did not have enough reserve funds to support their shops that could not open for service, did not have money to pay employees' salaries, and did not have money to pay rent, so they had to close down. Therefore, you should have reserve funds for operations for at least 6 months as a guarantee for long-term business operations.

7) Lack of ways to reduce costs in the store. For raw materials, we cannot avoid having to buy them, but we can manage the raw materials to be as cost-effective as possible and also help reduce costs, such as:

- Develop new menus from ingredients left over from cutting or original ingredients that are added to create more diverse menus.

- Properly storing raw materials can also help reduce the purchase of raw materials because they can be stored for a longer period of time and do not spoil easily.

- Cutting out menus that don't sell well will also reduce the amount of ingredients that need to be thrown away. All of these are #cost-cutting methods that don't require additional spending. But if you choose to use money to solve the problem instead, such as when the price of ingredients increases, you choose to buy the same amount and increase the selling price. This way, the risk of the shop going bankrupt is very high.

8) Not caring about taxes now may affect the restaurant's finances in the future because taxes are a duty and are required by law. Restaurants must study carefully what taxes they will have to pay.

- When it was still a small shop, sales were not that good, so we might have to pay personal income tax as usual.

- But if sales increase, you need to study VAT registration and other related taxes.